TL;DR

As the adoption of electric vehicles grows, UK businesses face challenges in fairly reimbursing employees for home charging. Factors like variable tariffs, data collection, and compliance with HMRC guidelines complicate this process. Paua Reimburse offers a streamlined solution to ensure accurate and fair compensation. In this article understand the importance of

1. charging costs at home

2. Capturing accurate data

3. Ensuring HMRC compliance

4. Public v home charging

And how Paua Reimburse can help

How to Fairly Reimburse Employees for EV Home Charging: A Guide for UK Businesses

As electric vehicles (EVs) become more prevalent across UK fleets, businesses are increasingly facing a unique challenge: how to fairly reimburse employees for charging their vehicles at home. While public charging solutions are relatively easy to monitor (thanks to Paua!), home charging introduces complexities that can make accurate reimbursement difficult. In this guide, we’ll explore the challenges businesses face when managing home EV charging reimbursement and how Paua Reimburse provides a clear and fair solution.

The Challenge of Home EV Charging Reimbursement

Reimbursing employees for home EV charging is not as straightforward as it may seem. Unlike traditional fuel reimbursements, which are based on standardised fuel prices, the cost of electricity for EV charging can vary significantly. Here are some of the key factors that make home charging reimbursement particularly challenging:

- Variable Energy Tariffs: Electricity rates vary by region, energy supplier, and even time of day (especially with off-peak tariffs). This makes it difficult to establish a consistent rate for home charging reimbursement.

- Complex Data Collection: It’s not easy to verify the amount of energy used for business miles versus personal travel, especially when employees are charging at home. Businesses need reliable data to ensure they are only reimbursing for business-related charging.

- Multiple Charging Locations: Employees may charge their vehicles at home, in public, and at work. Managing these different charging scenarios while ensuring fair reimbursement adds another layer of complexity.

- Tax Implications: Incorrect reimbursement methods can result in tax liabilities. It’s crucial to ensure that your reimbursement policy complies with HMRC guidelines, which don’t classify electricity as a fuel but still have specific rules regarding EV charging.

Why Fair Reimbursement Matters for UK Businesses

Fair and accurate reimbursement is not only a matter of financial equity, but it also fosters trust and transparency between employers and employees. When EV drivers are fairly compensated, they are more likely to feel valued and incentivised to support their company's sustainability goals. However, without the right tools and processes, businesses may risk undercompensating employees, leading to dissatisfaction, or overcompensating, increasing operational costs.

For many UK businesses, the Advisory Electricity Rate (AER) published by the government is a starting point for calculating EV charging reimbursements. However, the AER does not fully account for the higher costs associated with public charging, meaning that drivers who frequently use public networks may be left undercompensated.

Key Considerations for Fair EV Home Charging Reimbursement

To ensure a fair, transparent, and compliant reimbursement policy for home EV charging, businesses need to consider the following:

1. Understanding Charging Costs at Home

The cost to charge an electric vehicle at home can fluctuate based on several factors:

- Time-of-use energy tariffs

- Different energy providers’ pricing structures

- Variations in vehicle efficiency (miles per kWh)

By acknowledging these variations, businesses can better understand the true cost of home EV charging and develop reimbursement rates that accurately reflect real-world expenses.

2. Capturing Accurate Data

Accurate data collection is essential for fair reimbursement. Businesses need a system that captures the amount of electricity used specifically for business trips, differentiating it from personal usage. This requires more than simple odometer readings; it involves tracking charging events at home, public stations, and potentially at work.

3. Ensuring HMRC Compliance

Any reimbursement for EV charging must align with HMRC’s guidelines to avoid tax liabilities. If the reimbursement exceeds the AER, it may be treated as taxable income, making it subject to PAYE and National Insurance contributions. Businesses must ensure that their reimbursement methods are fully compliant to avoid costly tax implications.

4. Public vs. Home Charging

It’s important to recognise that public charging costs are often significantly higher than home charging. A fair reimbursement policy should factor in the higher cost of public charging to avoid undercompensating employees who charge away from home.

How Paua Reimburse Can Help

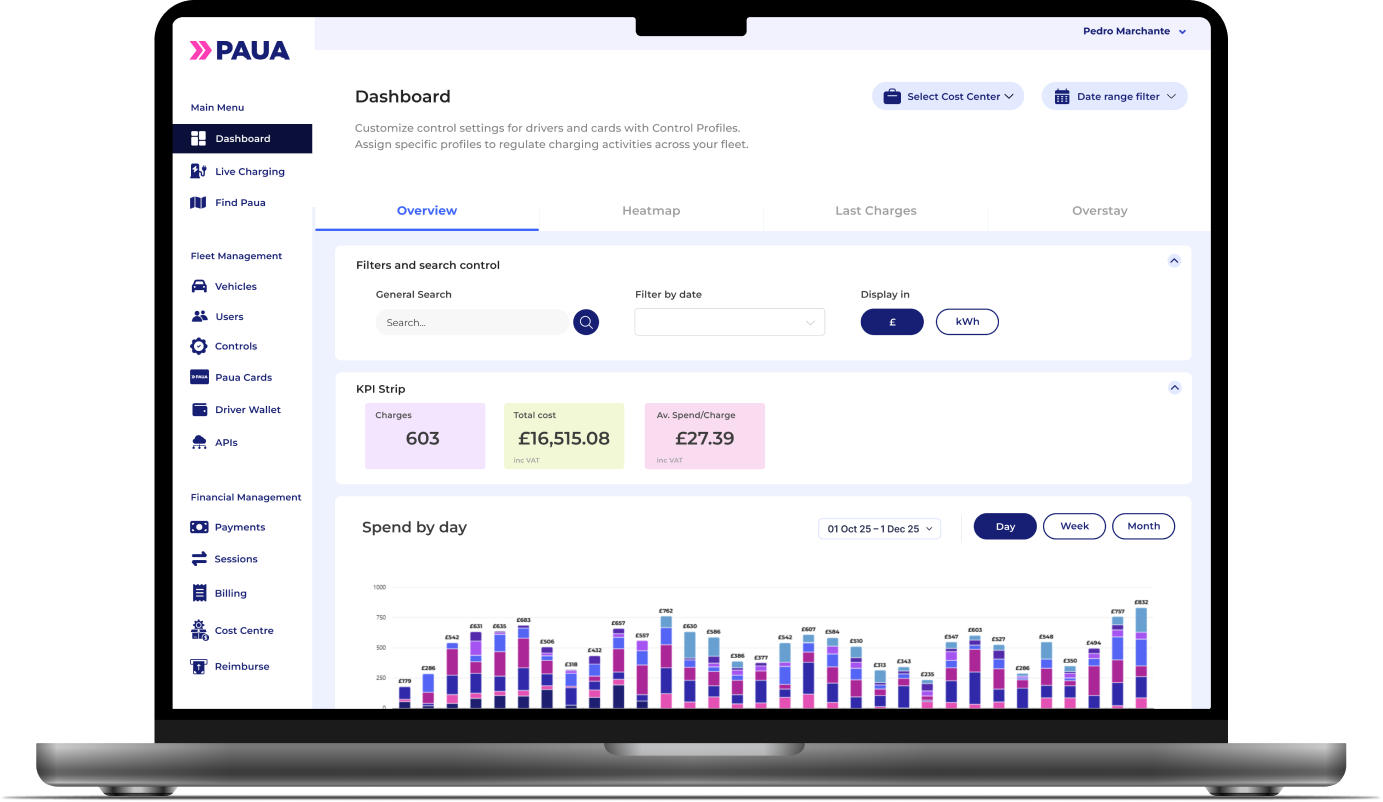

Paua Reimburse is designed specifically to address the challenges of fair EV charging reimbursement. It provides businesses with the tools needed to compensate employees accurately and fairly, no matter where they charge.

1. Comprehensive Data Integration

Paua Reimburse captures data from any charger, whether at home, work, or a public charging station, providing a holistic view of where and how much energy is used. This eliminates guesswork and ensures that all business-related charging is accurately recorded.

2. Flexible Reimbursement Methods

Paua Reimburse offers two approaches to EV charging reimbursement:

- Full cost reimbursement: Compensate drivers for the cost of charging, regardless of location at home or on the road.

- Reverse AER method: Adjust reimbursement based on the percentage of personal miles where the employee compensates the business based on their personal miles and pays at AER.

3. HMRC-Approved Approach

Paua Reimburse customers have achieved compliance with HMRC guidelines, giving businesses peace of mind that they are reimbursing employees correctly and avoiding potential tax liabilities.

4. Works with Any Vehicle, Any Charger

Unlike some solutions that require specific hardware or proprietary chargers, Paua Reimburse works with any EV and any charger, ensuring that businesses are not limited by infrastructure or compatibility issues.

Conclusion

Reimbursing employees for home EV charging doesn’t have to be complicated or unfair. With the right system in place, UK businesses can create transparent, HMRC-compliant policies that ensure employees are fairly compensated, no matter where they charge their vehicles. Paua Reimburse offers the flexibility, accuracy, and data integration needed to make this process seamless, supporting both your sustainability goals and your financial responsibilities.

To learn more about how Paua Reimburse can simplify your EV home charging reimbursements, contact us today.